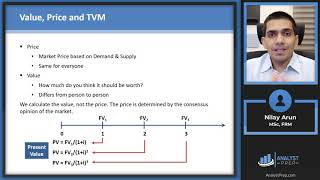

cfa tutorial: fixed income (calculating bond price)

Published 12 years ago • 313 plays • Length 2:27Download video MP4

Download video MP3

Similar videos

-

10:21

10:21

level i cfa® tutorial: fixed income - bond pricing

-

2:47

2:47

cfa tutorial: fixed income (buying & selling the bond)

-

8:04

8:04

level i cfa® tutorial: fixed income - reinvestment assumption in calculating yield to maturity: ytm

-

1:25

1:25

cfa tutorial: fixed income (time to maturity & coupon rate)

-

2:54

2:54

cfa tutorial: fixed income (bond duration & bond convexity)

-

1:41

1:41

cfa tutorial: fixed income (full price & clean price of a bond)

-

2:35

2:35

cfa tutorial: fixed income (reinvestment income & ytm:yield to maturity)

-

15:42

15:42

cfa® tutorial: fixed income investment / securities - bond valuation

-

5:08

5:08

cfa tutorial: fixed income (calculating macaulay duration for a bond)

-

1:59

1:59

cfa tutorial: fixed income (bond's indenture)

-

3:15

3:15

cfa tutorial: fixed income (zero coupon bond, accrual bonds & periodic interests)

-

2:43

2:43

cfa tutorial: fixed income (reinvestment risk for callable bonds & option free bonds)

-

1:45

1:45

cfa tutorial: fixed income (coupon bond & zero coupon bond)

-

1:40

1:40

cfa tutorial: fixed income (calculating marginal tax rate)

-

14:47

14:47

bond valuation (calculations for cfa® and frm® exams)

-

1:09

1:09

cfa tutorial: fixed income (non refundable bond)

-

11:11

11:11

fixed-income bond valuation:prices and yields - module 6 – fixed income– cfa® level i 2025