cfa tutorial: fixed income (calculating macaulay duration for a bond)

Published 12 years ago • 22K plays • Length 5:08Download video MP4

Download video MP3

Similar videos

-

14:37

14:37

cfa level 1 | fixed income: 4 ways to calculate macaulay duration of a bond

-

5:07

5:07

bond duration explained simply in 5 minutes

-

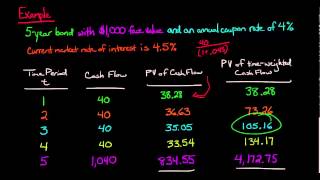

7:50

7:50

macaulay duration

-

2:54

2:54

cfa tutorial: fixed income (bond duration & bond convexity)

-

22:51

22:51

cfa level 3 | fixed income: macaulay duration, dispersion and convexity

-

2:27

2:27

cfa tutorial: fixed income (calculating bond price)

-

11:56

11:56

computing modified duration (for the @cfa level 1 exam)

-

4:24

4:24

cfa tutorial: fixed income (portfolio duration)

-

35:43

35:43

interest rate risk and return (2024/2025 cfa® level i exam – fixed income – learning module 10)

-

35:57

35:57

cfa level 1 - fixed income (part 2) - bond valuation (2)

-

9:08

9:08

calculating macauley, modified, and effective bond durations in excel

-

10:21

10:21

level i cfa® tutorial: fixed income - bond pricing

-

1:25

1:25

cfa tutorial: fixed income (time to maturity & coupon rate)

-

9:17

9:17

macaulay duration|modified duration| fixed income| cfa level 1

-

9:18

9:18

bond duration and bond convexity explained

-

15:42

15:42

cfa® tutorial: fixed income investment / securities - bond valuation

-

8:04

8:04

level i cfa® tutorial: fixed income - reinvestment assumption in calculating yield to maturity: ytm

-

36:42

36:42

cfa® / frm: calculating duration convexity and its effect on bond prices

-

1:59

1:59

cfa tutorial: fixed income (bond's indenture)

-

8:33

8:33

cfa level i: fixed income - duration calculation using bond function ba ii plus professional

-

2:35

2:35

cfa tutorial: fixed income (reinvestment income & ytm:yield to maturity)

-

29:51

29:51

macaulay duration & modified duration | exam fm | financial mathematics lesson 31 - jk math