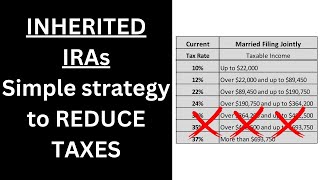

inherited ira rules and tax strategy

Published 3 years ago • 37K plays • Length 5:10Download video MP4

Download video MP3

Similar videos

-

6:28

6:28

inherited ira rules and tax strategy

-

7:21

7:21

minimizing taxes on inherited ira

-

18:50

18:50

non-spouse beneficiary inherited ira rules: 10-year rule, rmd requirement, exceptions, tax strategy

-

5:30

5:30

avoid the 10-year tax monster: inherited ira & 401k strategies

-

4:11

4:11

inherited ira withdrawal with no tax

-

5:34

5:34

inherited $400,000, what should i do with it?

-

8:15

8:15

how does tax-loss harvesting work?

-

9:14

9:14

new rules for inherited iras: 7 steps to follow

-

11:26

11:26

irs finalizes 10-year rule for inherited iras

-

14:08

14:08

rmds: inherited ira | confusing things you may not know about required minimum distributions

-

7:54

7:54

reduce taxes on big withdrawal from inherited ira

-

1:00

1:00

inherited ira explained: the 10-year distribution rule 😲 #retirementaccounts

-

5:43

5:43

irs finally clarifies rules on inherited iras rmds!

-

3:12

3:12

irs changes inherited ira rules - what you need to know

-

12:37

12:37

understanding the latest rules for inherited iras

-

2:33

2:33

how do i avoid paying taxes on an inherited ira?

-

8:12

8:12

inherited ira strategies & rules update

-

16:50

16:50

inherited ira - irs change to 10 year rule

-

25:47

25:47

inherited ira rules: what you need to know before 2025

-

7:39

7:39

non-spouse inherited iras & the 10 year rule: are rmd’s required?

-

0:47

0:47

what rich people know about 401k’s that you don’t 🚨

-

5:22

5:22

inherited ira tax trick!