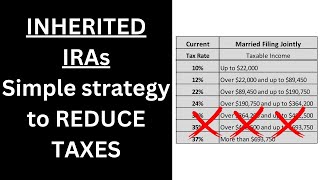

minimizing taxes on inherited ira

Published 1 year ago • 12K plays • Length 7:21Download video MP4

Download video MP3

Similar videos

-

7:54

7:54

reduce taxes on big withdrawal from inherited ira

-

7:09

7:09

shift inherited ira to your 401k - tax free!!!

-

4:36

4:36

2022 potential tax trap - inherited retirement accounts

-

4:53

4:53

tax planning with aging parents to minimize taxes for beneficiaries of retirement accounts

-

4:54

4:54

how to avoid 10% penalty on inherited ira (spouses under 59.5)

-

4:34

4:34

eliminate this hassle from your estate

-

6:34

6:34

how are social security benefits taxed?

-

6:07

6:07

how the rich avoid paying taxes

-

12:26

12:26

these 7 investments will reduce your taxes immediately

-

5:35

5:35

should i convert my retirement to roth?

-

3:20

3:20

congress changes ira & 401k required min distribution rules

-

9:16

9:16

medicare (irmaa) tax trap - what it is and how to avoid.

-

4:56

4:56

stepping up cost basis tax free (withouth dying)

-

0:14

0:14

minimize your #taxes on inherited iras

-

9:09

9:09

can long term capital gains push me into a higher tax bracket?

-

0:40

0:40

inherited ira secrets: avoid losing thousands to taxes!

-

6:28

6:28

inherited ira rules and tax strategy

-

5:10

5:10

inherited ira rules and tax strategy

-

5:21

5:21

how do inherited ira's work for non-spouse beneficiaries? (video has been replaced)

-

0:47

0:47

what rich people know about 401k’s that you don’t 🚨

-

1:00

1:00

inherited ira explained: the 10-year distribution rule 😲 #retirementaccounts