irs form 7203 - election under section 1.1367-1(g)

Published 1 year ago • 1K plays • Length 17:27Download video MP4

Download video MP3

Similar videos

-

6:55

6:55

how to complete irs form 7203 - s corporation shareholder basis

-

14:00

14:00

irs form 7203 - sale of s corporation stock with suspended losses

-

14:52

14:52

irs form 7203 - s corporation loss limitations on stock basis

-

18:24

18:24

irs form 7203 - s corporation losses allowed with stock & debt basis

-

23:40

23:40

didn't issue payroll for your s corp? here's what to do. | reasonable compensation workaround

-

33:46

33:46

how do i fill out form 941 if i have no employees 2023 q3

-

17:59

17:59

avoid these 5 s corp mistakes

-

11:42

11:42

irs form 7203 - how to calculate adjusted capital gain on stock sale

-

17:01

17:01

irs form 7203 - multiple blocks of s corporation stock

-

13:39

13:39

irs form 7203 - capital gain on distributions in excess of basis

-

42:24

42:24

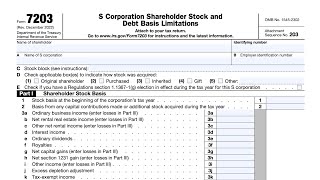

irs form 7203 walkthrough (s corporation shareholder stock and debt basis limitations)

-

1:20

1:20

webinar preview: preparing the new form 7203 for s corporation shareholders

-

25:40

25:40

what is irs form 7203 and how does it work?

-

1:13

1:13

irs how to calculate s corp basis on form 7203 with limited k1 info

-

5:40

5:40

form 7203 & s-corp tax basis

-

3:59

3:59

form 1120-s schedule b-1....disclosure of shareholders...

-

0:30

0:30

the implications of s corporation shareholders taking distributions in excess of their basis.

-

18:34

18:34

facebook live replay: introducing form 7203 with natp instructor amy wall

-

1:13

1:13

rev. rul. 2004-85, f reorganization of an s corp did not terminate qsub election for subsidiary