what is irs form 7203 and how does it work?

Published Streamed 1 year ago • 3.2K plays • Length 25:40Download video MP4

Download video MP3

Similar videos

-

6:55

6:55

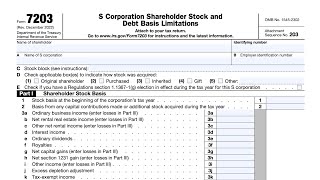

how to complete irs form 7203 - s corporation shareholder basis

-

42:24

42:24

irs form 7203 walkthrough (s corporation shareholder stock and debt basis limitations)

-

14:52

14:52

irs form 7203 - s corporation loss limitations on stock basis

-

18:24

18:24

irs form 7203 - s corporation losses allowed with stock & debt basis

-

18:34

18:34

facebook live replay: introducing form 7203 with natp instructor amy wall

-

11:46

11:46

never buy these types of houses

-

19:44

19:44

tax form 1099-r explained || taxable retirement distributions or not?

-

16:55

16:55

how to file itr 1701q using ebirforms with 2307, sawt data entry, validation & esubmission

-

17:27

17:27

irs form 7203 - election under section 1.1367-1(g)

-

8:43

8:43

rrsp vs tfsa vs fhsa: where should you invest your money? | financial audit 🇨🇦

-

![s corp basis 7203: new irs form 7203 [s corporation] shareholder stock & debt basis limit form 1040](https://i.ytimg.com/vi/EaPvB98yCZQ/mqdefault.jpg) 6:26

6:26

s corp basis 7203: new irs form 7203 [s corporation] shareholder stock & debt basis limit form 1040

-

1:20

1:20

webinar preview: preparing the new form 7203 for s corporation shareholders

-

14:02

14:02

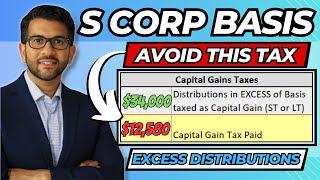

s corp basis explanation | distributions in excess of basis

-

6:44

6:44

irs form 7203 developments - shareholder basis reporting for s corporations 2021

-

17:01

17:01

irs form 7203 - multiple blocks of s corporation stock

-

6:06

6:06

form 7203 s-corporation basis reporting

-

0:35

0:35

what is irs form 720? - taxfaqs

-

5:40

5:40

form 7203 & s-corp tax basis

-

17:54

17:54

tufts on tax–episode 27- new irs form 7203