irs form 8971 walkthrough (information regarding beneficiaries acquiring property from a decedent)

Published 1 year ago • 1.2K plays • Length 22:40Download video MP4

Download video MP3

Similar videos

-

25:31

25:31

irs form 6252 walkthrough (installment sale income)

-

14:55

14:55

irs form 4422 walkthrough (applying for certificate discharging property subject to estate tax lien)

-

22:02

22:02

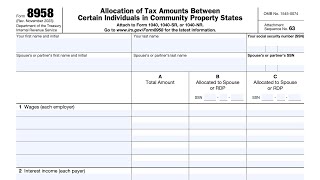

irs form 8958 walkthrough (allocating tax between certain individuals in community property states)

-

25:20

25:20

irs form 8854 walkthrough (initial and annual expatriation statement)

-

27:26

27:26

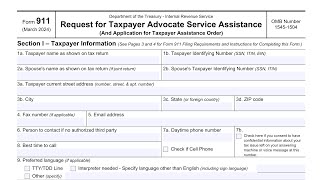

irs form 911 walkthrough (request for taxpayer assistance)

-

25:13

25:13

irs form 8821 walkthrough (tax information authorization)

-

9:15

9:15

irs form 8944 walkthrough (tax preparer irs efile hardship waiver request)

-

3:31

3:31

confidentiality of information: reporting to irs (irc 6103, form 211) - your guide

-

22:25

22:25

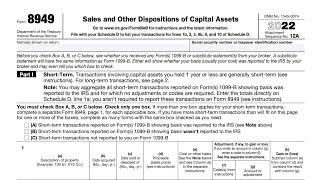

irs form 8949 walkthrough (sales and other dispositions of capital assets)

-

13:05

13:05

how to file irs form 4797 - nonrecaptured section 1231 losses on sale of real estate

-

13:07

13:07

irs form 8582 walkthrough (passive activity loss limitations)

-

2:22

2:22

when is an estate tax return required

-

22:03

22:03

irs form 14135 walkthrough (discharging property from a federal tax lien)

-

0:31

0:31

what is irs form 8594? - taxfaqs

-

35:45

35:45

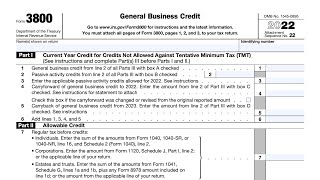

irs form 3800 walkthrough (general business credit)

-

10:28

10:28

irs form 3903 walkthrough (moving expense deduction)

-

15:43

15:43

irs form 3949-a walkthrough (information referral)

-

18:05

18:05

irs form 4952 walkthrough (investment interest expense deduction)

-

16:54

16:54

irs form 8821 walkthrough - archived copy - read comments only

-

25:40

25:40

what is irs form 7203 and how does it work?