s-corporation: draws vs salary

Published 5 years ago • 4.3K plays • Length 6:01Download video MP4

Download video MP3

Similar videos

-

10:08

10:08

owners draw vs payroll salary? how to pay yourself from your business!

-

9:05

9:05

understanding s corp distributions: a simple guide for business owners

-

4:26

4:26

s-corporation: will my bookkeeping change?

-

9:18

9:18

accounting for s-corporations: what you need to know

-

4:51

4:51

estimated taxes as an s-corporation

-

5:22

5:22

estimated taxes, payroll withholding & s-corp - live ama

-

3:05

3:05

how to pay yourself: shareholder salary vs. dividends or distributions

-

7:01

7:01

tips on s corp basis, distributions and shareholder loans

-

15:09

15:09

business owner pays tax on s-corporation distribution

-

5:44

5:44

how to calculate s corp debt basis?

-

3:58

3:58

✅ s corporation taxes explained in 4 minutes

-

6:30

6:30

what is the basis for my s-corporation?

-

3:14

3:14

acctg332 video22e s corp distributions

-

0:21

0:21

what is an s-corp “reasonable salary?” (pay yourself the correct way)

-

10:08

10:08

owner's draw vs. salary (what's the difference?) payroll distributions in quickbooks online

-

14:02

14:02

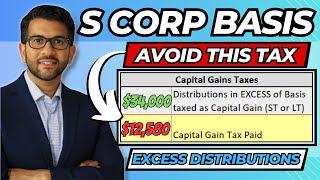

s corp basis explanation | distributions in excess of basis

-

11:49

11:49

taxation in an s corporation (distributions vs owner's compensation

-

0:50

0:50

how to pay yourself when you start an llc taxed as an s-corp... 💸 big tax savings tip! #shorts

-

1:00

1:00

s corp saving payroll tax, how does it work?

-

10:53

10:53

s corp reasonable salary - an in-depth guide

-

7:50

7:50

are owner drawings taxable?

-

0:48

0:48

reduce employment taxes with an s corporation