what is the basis for my s-corporation?

Published 3 years ago • 16K plays • Length 6:30Download video MP4

Download video MP3

Similar videos

-

9:18

9:18

accounting for s-corporations: what you need to know

-

11:21

11:21

how to calculate basis for s corporation stock

-

4:51

4:51

estimated taxes as an s-corporation

-

14:02

14:02

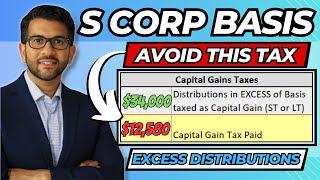

s corp basis explanation | distributions in excess of basis

-

6:18

6:18

what is a shareholder basis?

-

6:19

6:19

can i do my own s-corporation tax return?

-

6:01

6:01

s-corporation: draws vs salary

-

11:22

11:22

describe yourself in 3 words! (how to answer this tricky interview question!)

-

13:22

13:22

windows user switches to macbook pro

-

13:23

13:23

job interview conversation in english | job interview questions and answers | job interview |

-

10:55

10:55

when should your therapy practice become an s-corporation?

-

8:02

8:02

s corporation indebtedness and shareholder basis

-

4:26

4:26

s-corporation: will my bookkeeping change?

-

5:44

5:44

how to calculate s corp debt basis?

-

14:52

14:52

irs form 7203 - s corporation loss limitations on stock basis

-

22:39

22:39

s-corp basis explained

-

7:00

7:00

distributions from s corporation. cpa exam

-

0:06

0:06

why should we hire you? (the best answer to use in job interviews!)

-

17:01

17:01

irs form 7203 - multiple blocks of s corporation stock

-

0:26

0:26

what are your salary expectations? (best answer to this job interview question!) #salaryexpectations

-

6:55

6:55

how to complete irs form 7203 - s corporation shareholder basis