taxes on producers- micro topic 2.8

Published 10 years ago • 1.5M plays • Length 5:58Download video MP4

Download video MP3

Similar videos

-

11:37

11:37

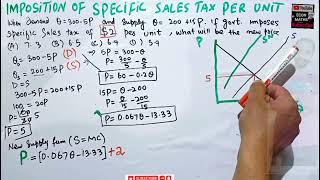

impact of per unit tax on demand and supply

-

16:04

16:04

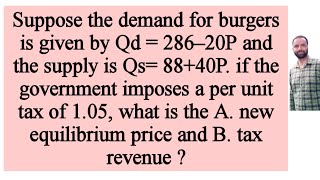

equilibrium price and tax revenue after the imposition a per unit tax from demand & supply function

-

6:22

6:22

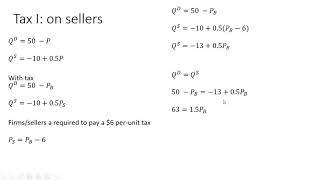

supply and demand with tax

-

8:19

8:19

mathematical example of the incidence of a unit tax

-

12:10

12:10

per unit tax and tax revenue #microeconomics

-

20:33

20:33

economic incidence of tax , govt tax revenue , deadweight loss, per unit tax on seller.

-

15:14

15:14

taxes on buyers and sellers

-

6:03

6:03

impact of per unit tax in perfectly competitive market and deadweight loss

-

15:20

15:20

tax incidence formula from demand and supply model using elasticities

-

2:12

2:12

micro unit 6, question 12- tax incidence (excise tax)

-

3:06

3:06

taxes on consumers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

0:27

0:27

how to answer any question on a test

-

6:51

6:51

supply and demand: tax on buyers

-

5:36

5:36

consumers prefer lump-sum taxes to per-unit taxes

-

0:23

0:23

how chinese students so fast in solving math over american students

-

0:14

0:14

quantum physics edit | status | #physics #maths #quantum #shorts

-

0:11

0:11

sukoon❤️ my ca intermediate result! cleared my first group🔥 #castudentlife #resultreaction #cainter

-

0:25

0:25

topper vs average student 😮 | dr.amir aiims #shorts #trending

-

3:40

3:40

tax cut: which side of the market benefits most?