when not to use form 8949?

Published 6 months ago • No plays • Length 0:36Download video MP4

Download video MP3

Similar videos

-

0:44

0:44

who gets form 8949?

-

22:25

22:25

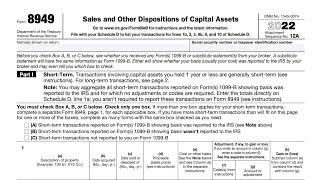

irs form 8949 walkthrough (sales and other dispositions of capital assets)

-

2:35

2:35

when to use irs form 8949 for stock sales - turbotax tax tip video

-

1:36

1:36

one step 2022 form 8949

-

3:04

3:04

how to use irs form 8949 for reporting capital gains and losses?

-

5:22

5:22

reporting capital gains on irs form 8949 and schedule d

-

2:11

2:11

how to easily report capital gains on form 8949 using the form8949.com app

-

10:43

10:43

form 8949 & generally, what is the disposition of assets

-

10:34

10:34

irs form 1099-int: how to account for accrued interest on bond purchases

-

40:11

40:11

how to record sale of publicly traded partnership (ptp) units on form 1040

-

25:00

25:00

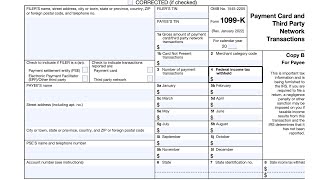

irs form 1099-k walkthrough (payment card & third party network transactions)

-

1:12:55

1:12:55

tradelog class: reconciling 1099-b and ending the tax year, form 8949

-

1:53

1:53

tutorial 5.5: adjusting form 8949 code

-

6:09

6:09

how to fill out irs form 8949

-

3:07

3:07

how to generate 2011 irs schedule d and form 8949 using www.form8949.com

-

0:59

0:59

what is the difference between form 1040 and 8949?

-

1:50

1:50

how to report capital gains for tax year 2022 for as little as $12.00

-

1:27:12

1:27:12

greentradertax cost-basis reporting update: how to file the new tax form 8949

-

14:31

14:31

irs capital gains and losses/schedule d and form 8949

-

3:57

3:57

how to generate irs form 8949 - broker electronic import without cursing

-

0:46

0:46

what is a form 1099-b?