microeconomics practice problem - the algebra of taxes, government revenue, and deadweight loss

Published 11 years ago • 17K plays • Length 22:09Download video MP4

Download video MP3

Similar videos

-

11:31

11:31

tax revenue and deadweight loss

-

5:58

5:58

taxes on producers- micro topic 2.8

-

17:51

17:51

microeconomics practice problem - price elasticity and the deadweight loss of taxation

-

10:49

10:49

microeconomics practice problem - tax rates versus tax revenue

-

9:06

9:06

taxation and dead weight loss | microeconomics | khan academy

-

36:53

36:53

microeconomics practice problem - the math behind externalities and corrective taxes

-

3:12

3:12

taxes on producers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

17:40

17:40

q&a:- demand and supply part three

-

32:21

32:21

chapter 8: the costs of taxation

-

13:45

13:45

micro: unit 1.6 -- consumer surplus, producer surplus, and deadweight loss

-

3:06

3:06

taxes on consumers | part 1 | tax revenue and deadweight loss of taxation | think econ

-

23:26

23:26

microeconomics practice problem - taxes, consumer surplus, and producer surplus

-

4:43

4:43

taxes on producers | part 2 | tax revenue and deadweight loss of taxation | think econ

-

13:41

13:41

microeconomics practice problem - the cost of externalities and the logic of corrective taxes

-

16:04

16:04

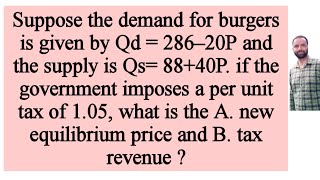

equilibrium price and tax revenue after the imposition a per unit tax from demand & supply function

-

5:39

5:39

taxes on consumers | part 2 | tax revenue and deadweight loss of taxation | think econ

-

12:29

12:29

taxes: crash course economics #31

-

3:23

3:23

what is deadweight loss?

-

7:54

7:54

size of a tax, deadweight loss, and the laffer curve - principles of microeconomics - mankiw ch 8

-

0:41

0:41

deadweight loss is a choice, lvt would solve it! #shorts #economics #landvaluetax #taxes

-

0:59

0:59

the economics of eliminating taxes on tips

-

0:16

0:16

#shorts per unit tax on sellers